In 2008, the Pension and Disability Insurance Fund (PIO), then headed by the newly elected Central Bank Governor Radoje Zugic, had €16.5 million deposited in Prva Banka. It was at his time as the head of the Fund when its deposits with Prva Bank significantly increased.

The Pension Fund, the Investment Development Fund (IDF) and the Health Insurance Fund, the three major state-owned funds, have played one of the leading roles in saving Prva banka in 2007, 2008 and 2009, i.e. se years that were the most critical for its survival. They increased their deposits almost 30 times in comparison to the time when the Bank was owned by the state.

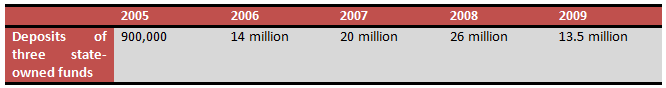

Official documentation held by MANS Investigation Center and the daily Dan shows that in 2005 the state funds had some €900,000 deposited in the bank, which was then called Niksicka Banka and was state-owned.

Starting from the following year, 2006, when Aco Djukanovic became the major shareholder of the bank, the funds started depositing more significant amounts. That year, the Pension Fund deposited €6.1 million, the Development Fund deposited €7.8 million, making it a total of nearly €14 million.

Financial problems of Prva Banka began in 2007, and in the same year the Pension Fund increased its deposits to €11.6 million, the Development Fund reduced its deposits to €6.6 million, while the Health Insurance Fund placed the money, €1.3 million, in Prva Banka for the first time. This means that the three state-owned funds had almost €20 million in the bank of the prime minister’s brother in 2007.

The amount of deposits of the three state-owned funds in Prva Banka in 2008 further increased to €26 million, while the Pension Fund increased its deposit to €16.5 million, the Health Insurance Fund tripled its amount to €4.6 million, while the Development Fund was the only one to decrease the deposit to €4.8 million. At the end of the same year, Prva Banka received €44 million of aid from the state budget in order to maintain liquidity.

By the end of 2009, the money from the recapitalization of Elektroprivreda Crne Gore was deposited in Prva Banka, enabling it to avoid financial collapse. At the same time, the state-owned funds reduced their deposits in the bank belonging to the prime minister’s brother to a total of €13.5 million – the Pension Fund had €8.8 million, the Development Fund had €4.7 million, while the Health Insurance Fund almost completely withdrew the deposits from Prva Banka.

The decrease in total government deposits, and not only state funds, was one of the demands of the international credit institutions, with which Montenegro was negotiating to obtaining loans in order to improve the liquidity of the budget in those years. The network of Investigative journalists Organized Crime and Corruption Reporting Project (OCCRP) has revealed earlier that Montenegro did not have access to a favorable World Bank loan of €60 million for two years, because state officials had not settled the situation in Prva Banka and withdrawn deposits from it.

After the government promised to withdraw the deposits from Prva Banka, a loan agreement with the World Bank was signed in September 2011, a little more than two years after the start of negotiations. During the period of negotiations, the government borrowed from commercial banks under unfavorable conditions, and its foreign debt was tripled in that period from €59 to €553 million.

MANS Investigation Center does not possess of the contract on term deposit of the state funds in Prva Banka. Pension Fund refused to submit such contracts, on the grounds of business secrets, the disclosure or use of which, without the express consent of the owner, would constitute unauthorized use of the submitted data, As a result, MANS will initiate appropriate legal proceedings.

Meanwhile, separate data that MANS possesses show that at the end of 2009, when the Pension Fund had €8.8 million deposited in Prva Banka, the outstanding liabilities of the Fund for net pensions and suspensions towards banks and other legal entities amounted to €29 million.

Apart from the three state-owned funds, in the years of crisis of Prva Banka, even the government, its agencies, municipalities with public organizations and companies with majority state ownership kept deposited tens of millions of euro, thus maintaining its liquidity and saving it from financial ruin.

Former president of the Board of Directors

Radoje Zugic was the acting director of the Pension and Disability Insurance Fund from February 2004 to January 2005, when he was elected director of the state fund by the decision of the Board of Directors. He was re-elected in January 2009.

During 2008 he was also the chair of the Board of Directors of Prva Banka and it was Zugic who signed the Agreement on Credit support of the Government of Montenegro in the amount of €44 million on behalf of the prime minister’s brother’s bank.

Zugic covered several functions. Among other things, he was the Governor of the Central Bank, which means that he was supposed to control Prva Banka, in which, at some point of time, he was the chair of the Board of Directors.

Meanwhile, he was also a representative of the Democratic Party of Socialists in the national parliament, and later was appointed Minister of Finance in the government of Milo Djukanovic.

IDF still keeps deposits with Aco’s bank

In 2010, the Development Fund was transformed into a shareholding company Investment Development Fund, and its deposits were separated from the state deposits. From then on, the government has not been showing separately deposits of the Health Insurance Fund and the Pension Fund in the final accounts of the annual budget, but displays them along with the rest of their deposits as a unitary deposit of the state budget.

According to those data, in 2010, the government had €27.9 million deposited in Prva Banka, in 2011 it had €10.4 million, in 2012 the sum was reduced to €3.5 million, in 2013 it amounted to less than €600,000, it was €35,000 thousand a year later and €69,000 at the end of the last year.

On the other hand, since 2010, when it was organized as a joint stock company, until the end of the last year, the IDF held annually on the average one-third of the money in the bank the prime minister’s brother, on the basis of short-term financial investments, or term deposits for the period of three months up to one year.

Thus, in 2010, from €19.5 million deposited, it kept €7 million in Prva Banka, in 2011 the deposits decreased to €11.3 million, of which €4.2 million was kept in Prva Banka, while a year later it had €8,3 million, of which €2.3 million was kept in the bank belonging to the prime minister’s brother.

At the end of 2013, the IDF had a total of €9.2 million, of which 2.3 million was deposited in Prva Banka, while the following year of €8 million it had, €1.5 million was kept in Prva Banka. The same amount was kept the last year as well, although the total deposited amount shown at the end 2015 was €4.1 million.

IDF’s financial statements did not show specific interest rates at which it agreed on deposits with certain banks, including Prva Banka, but has been vaguely noted that by 2013 it had agreed on short-term financial investments at rates ranging from 5.5 to 6.5 percent. These rates were later reduced, so at the end of the last year, the agreed rates ranged from 3.3 to 4.1 percent.

Authors:

Ines Mrdovic

Milica Krgovic

This text is created with the support of the European Union within the project “Zero Tolerance to Corruption”. Network for Affirmation of Non-Governmental Sector – MANS is solely responsible for the contents of this article, and the views taken herein shall not in any case be considered as those of the European Union.